.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

Regensburg, February 21, 2021. Vitesco Technologies, a leading international provider of modern drive technologies and electrification solutions for sustainable mobility, today published its preliminary figures for the fiscal year 2021.

Since its listing on the stock exchange in September 2021 following the spin-off from Continental, Vitesco Technologies operates as an independent company. The company is satisfied with the results: its transformation strategy has proven successful, even in the face of the Corona pandemic, delays in delivery and the ongoing semiconductor shortage.

Revenue growth exceeds general market trend

Vitesco Technologies raised its group revenues to € 8.3 billion in the reporting period (2020: € 8.0 billion). Adjusted for changes in the scope of consolidation and exchange rate fluctuations, revenues rose by 4.1 percent. With this increase, the company slightly outperformed the overall market, which experienced a growth of

3.4 percent in 2021. Chinese and European markets were key revenue drivers. Business unit Electrification Technology showed the strongest growth with a plus of 44.6 percent.

Adjusted EBIT amounted to € 148.6 million (2020: € -94.5 million). The adjusted EBIT margin at 1.8 percent (2020: -1.2 percent) was slightly above the announced target range of 1.5 percent to 1.7 percent.

With a free cash flow of € 113.3 million (2020: € -455.7 million), the company reached the upper end of the projected bandwidth of € 70 to 120 million. The increase is attributable to significant operating improvements.

Free cash flow comprises cash outflows for capital expenditure on property, plant and equipment and software (without considering values in use) in the amount of € 441.3 million (2020: € 428.4 million). This corresponds to 5.3 percent of revenues and is within the expected range of 5.2 to 5.5 percent.

The balance sheet of Vitesco Technologies remains very solid with an equity ratio of 36.3 percent as of December 31, 2021 (December 31, 2020: 32.9 percent). The group’s net liquidity stood at € 345.1 million at the end of the fiscal year (December 31, 2020: € 405.7 million).

“We have fully met our forecast for 2021 for all key financial figures. Thanks to strict cost discipline and our successful transformation, we noticeably improved our operating profit. We are even slightly above the forecast range,” adds Werner Volz, CFO of Vitesco Technologies. “Despite the persistent weakness in the market for semiconductors, resulting additional costs and higher stockpiling of selected products, we achieved a positive free cash flow of about 113 million euros.”

Business unit results

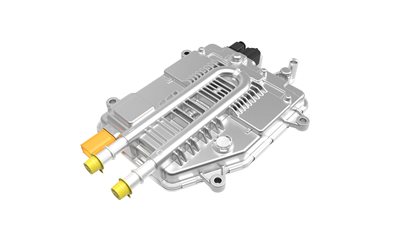

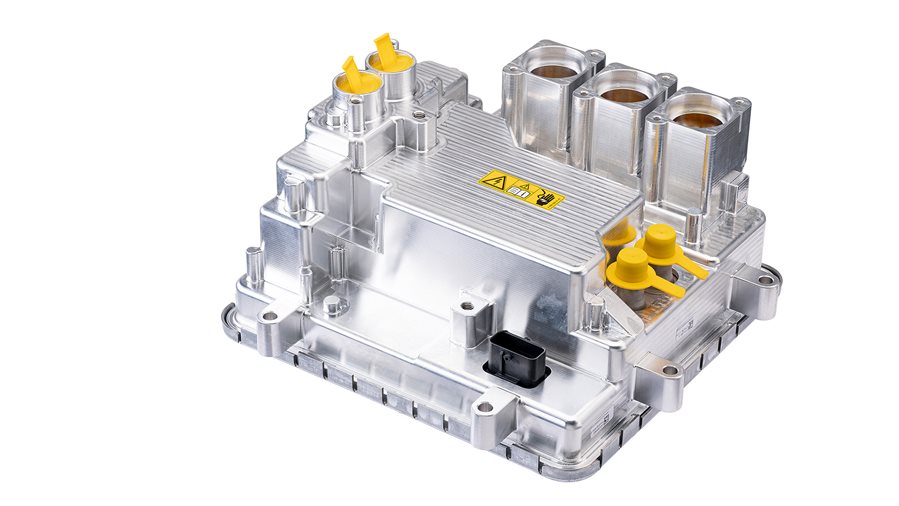

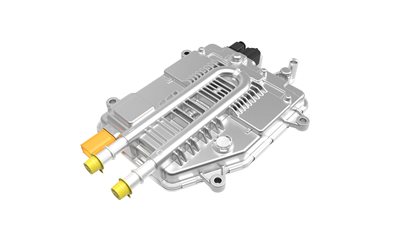

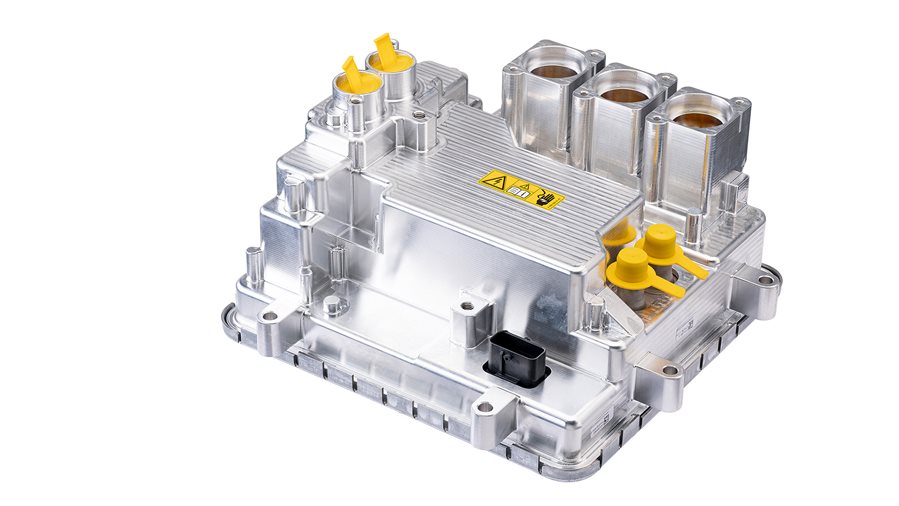

Business unit Electrification Technology recorded a considerable revenue growth of 44.6 percent to € 587.1 million (2020: € 405.9 million), driven by the high demand for high-voltage electric drives and power electronics. Adjusted EBIT improved to € -273.0 million (2020: € -345.7 million) despite continued high upfront costs for future projects. This corresponds to an adjusted EBIT margin of -46.5 percent (2020: -85.2 percent).

In Electronic Controls, revenues in 2021 decreased slightly to € 3.5 billion (2020: € 3.6 billion). Adjusted EBIT, by contrast, increased to € 117.2 million (2020: € 85.6 million), corresponding to an adjusted EBIT margin of 3.3 percent (2020: 2.4 percent). Continued transformation activities were the main reason for the improvement in profit. Contrary effects resulted from higher costs related to semiconductor supply shortages.

In the Sensing & Actuation business unit, revenues rose at double-digit rates to € 3.2 billion in 2021 (2020: € 2.9 billion). The recovery of the commercial vehicle market particularly in China as well as the strong demand from some European regions could partly offset surging material prices resulting from the challenging semiconductor market situation. Adjusted EBIT increased significantly to € 269.2 million (2020: 107.7 million). This represents an improved adjusted EBIT margin of 8.4 percent (2020: 3.7 percent). The improvement was mainly attributable to economies of scale and restructuring measures in non-core technologies – both operational performance and reducing fixed costs had a positive impact on operating income development.

Revenues in the fourth business unit Contract Manufacturing, which bundles order production for Continental AG, amounted to € 1.1 billion in fiscal year 2021 (2020: € 1.1 billion). Adjusted EBIT decreased to € 42.7 million (2020: € 53.3 million), the adjusted EBIT margin fell to 4.1 percent, as expected. In the previous year, it had been 4.9 percent.

At our Annual Press Conference on March 25, 2022, we will publish a comprehensive overview of the Group's performance in the past fiscal year 2021 and guidance for the current fiscal year 2022.