.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

Regensburg, Germany, November 14, 2022. Vitesco Technologies, a leading international developer and manufacturer of state-of-the-art powertrain technologies for sustainable mobility, today announced its third quarter 2022 results.

Group sales in the third quarter came in at €2.30 billion (Q3 2021: €1.91 billion). Adjusted for changes in the scope of consolidation and exchange-rate effects, sales increased by 13.6 percent. Electrification sales amounted to €230 million in the third quarter.

Adjusted operating profit increased year-on-year to €47.9 million (Q3 2021: €24.5 million), corresponding to an adjusted EBIT margin of 2.1 percent (Q3 2021: 1.3 percent). The net income increased to ‑€13.8 million (Q3 2021: -€91.5 million) and to earnings per share of ‑€0.34 (Q3 2021: -€2.29), respectively.

Due in particular to the further build-up of inventories, free cash flow was slightly negative at -€16.3 million. A significant improvement was achieved compared to the prior-year quarter (Q3 2021: -€213.2 million). However, the previous year was also significantly influenced by spin-off effects. Vitesco Technologies has a solid balance sheet as of September 30, 2022, with an equity ratio of 40.7 percent (September 30, 2021: 37.1 percent).

New order booked for battery management system worth €600 million

In a market environment that remains challenging, Vitesco Technologies can look back on a solid third quarter with strong order intake. The volume of new orders booked in the third quarter came in at €4.3 billion, of which €3.2 billion was for electrification products in all business units.

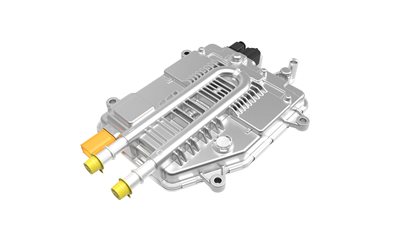

This order volume from the past quarter also includes an order worth around €600 million from a global German automotive manufacturer for Vitesco Technologies’ battery management system (BMS). As Wolf puts it, “This means that, so far in 2022, we have booked orders for our battery management system worth a total value of €3 billion.”

The business units at a glance

The Electrification Technology business unit generated sales of €147.2 million in the third quarter of 2022 (Q3 2021: €128.9 million). Organic sales grew by 16.0 percent. Adjusted operating profit decreased to -€71.0 million (Q3 2021: -€69.2 million). In the past quarter, the adjusted EBIT margin was -48.2 percent (Q3 2021: ‑53.7 percent). The business unit continues to be burdened by ramp-up costs and the research and development expenses included therein. In addition, production volumes in China had to be reduced for a short period of time due to capacity expansions. The business unit continues to achieve high order intake, amounting to €1.9 billion in the third quarter.

In the Electronic Controls business unit, sales in Q3 2022 were €1.03 billion (Q3 2021: €806.8 million). Organic growth amounted to 21.2 percent. Adjusted operating profit was €44.5 million (Q3 2021: €30.1 million), corresponding to an adjusted EBIT margin of 4.3 percent (Q3 2021: 3.8 percent). Improved availability of semiconductors and the successive passing on of additional costs to customers led to an increase in sales. Nevertheless, a lack of customer-specific electronic parts in particular continues to pose a major challenge for the business unit.

For the Sensing & Actuation business unit, sales in Q3 2022 increased to €879.9 million (Q3 2021: €746.7 million). Organic growth amounted to 11.0 percent. Also in this business unit, the improved availability of semiconductors had a positive impact on business. In addition, strong sales growth was noticeable in North America and Germany. Adjusted operating profit was €78.0 million (Q3 2021: €53.5 million), corresponding to an adjusted EBIT margin of 8.9 percent (Q3 2021: 7.2 percent).

Adjusted outlook for the full year 2022

In the current fiscal year 2022, Vitesco Technologies expects global vehicle production to increase by 5 to 7 percent (previously: 3 to 5 percent) compared to the previous year. For the European market, a decline between -1 to -3 percent (previously: 3 to 5 percent) is expected, while double-digit growth rates (10 to 12 percent; previously: 11 to 13 percent) are still forecast for North America. According to company estimates, production figures in China have changed significantly (5 to 7 percent); previously, company estimates had assumed stagnation (-2 to 0 percent).

Due to expected higher global passenger car production figures, as well as effects from currency effects and price adjustments, Vitesco Technologies is raising its 2022 sales forecast to €9.0 to 9.2 billion. Previously, the company was anticipating full-year sales of €8.6 to 9.1 billion.

However, as not all additional costs can be passed on, Vitesco Technologies expects an adjusted operating EBIT margin of 2.3 to 2.5 percent (previously: 2.2 to 2.7 percent) for the full year 2022, also considering the year-to-date performance. In view of the global uncertainties, Vitesco Technologies is lowering its capital expenditure ratio1 for 2022 to around 5 percent (previously: around 6 percent). Overall, free cash flow of more than €75 million (previously: more than €50 million) is expected in fiscal year 2022.

Footnotes:

1 Capital expenditure excluding right-of-use assets (IFRS 16).

© Vitesco Technologies GmbH (exclusive rights)