.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

Regensburg, October 17, 2023. The Executive Board and Supervisory Board of Vitesco Technologies Group AG ("Vitesco Technologies”) will comply with their fiduciary duties to evaluate the voluntary public purchase offer for all outstanding shares of Vitesco Technologies and the merger of Vitesco Technologies into Schaeffler AG ("Schaeffler”) intended by Schaeffler, taking into account the interest of all Vitesco Technologies stakeholders, including all shareholders as well as the company and its employees. The Boards note the concerns that Vitesco Technologies shareholders and employee representatives have voiced since the unsolicited offer by Schaeffler was announced last Monday. These concerns anchor around the price offered and the prospects of Vitesco Technologies in a merged entity.

Since its listing in 2021, the company has rigorously followed a self-funded transformation strategy to become an electrification powerhouse and is fully on track to deliver on its short-, mid- and long-term targets.

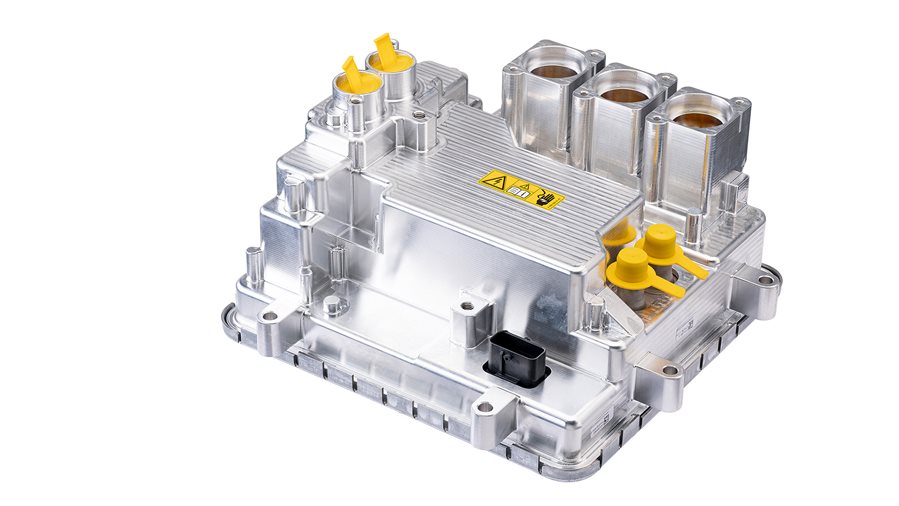

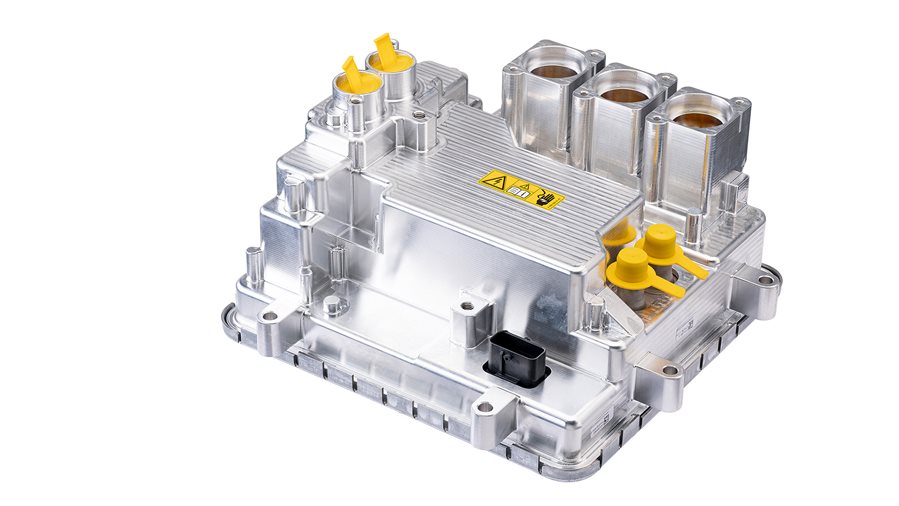

Globally, Vitesco Technologies is among the largest powertrain players and has continuously improved profitability despite major industry headwinds. It successfully ramped up its electrified business with more than €1 billion sales of electrification components in 2022.

The electrification order intake of more than €10 billion during FY 2022 underlines the company’s future profitable growth trajectory. In the last quarter, 90 percent of the order intake was related to electrification products. This clearly demonstrates that the transition to electromobility is gaining momentum and will be the key growth driver over the next years. The electrification business is expected to break even in 2024. Vitesco Technologies targets €5 billion in sales with electrification products for 2026. 100 percent of those sales are already booked.

Vitesco Technologies has built a strong capital markets track record, outperforming major indices and peers since its listing in 2021. In 2023 alone, Vitesco Technologies’ share price has increased by 39 percent, before the offer by Schaeffler was announced. Vitesco Technologies has been fully on track to drive long-term value creation for its shareholders.

The Supervisory Board of Vitesco Technologies has now formed an independent Special Committee to evaluate the public purchase offer by Schaeffler. This Special Committee consists exclusively of members of the Supervisory Board without a dual mandate at Schaeffler.

In assessing the offer, the Executive Board and the Special Committee of the Supervisory Board will determine whether the premium offered by Schaeffler to Vitesco Technologies’ shareholders is financially adequate for all shareholders, recognizing the company’s value and perspectives of profitable growth in a market that offers tremendous potential. In addition to the financial implications for the shareholders of Vitesco Technologies, they will also evaluate how the merger planned by Schaeffler will affect the company’s ability to realize its strategic targets and the company’s workforce.

A reasoned statement on the offer including a recommendation to shareholders pursuant to section 27 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz, WpÜG) will be published once the Boards have comprehensively and carefully assessed the offer document, to be published by Schaeffler.