.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

Regensburg, March 14, 2024. Vitesco Technologies, a leading international provider of modern drive technologies and electrification solutions for sustainable mobility, is today publishing its consolidated financial statements for fiscal year 2023. The company had already published preliminary results on February 23, 2024, in which it fully achieved – and in some cases exceeded – its own forecast for all key financials.

In 2023, Vitesco Technologies increased its consolidated sales to €9.23 billion despite a persistently challenging market environment (2022: €9.07 billion). Adjusted for changes in the scope of consolidation and exchange-rate effects, sales increased by 4.4 percent.

Due to the further improvement in operating performance, the company’s adjusted EBIT margin of 3.7 percent (2022: 2.5 percent) was much higher than its forecast range of 2.9 percent to 3.4 percent. The adjusted EBIT thus amounted to €341.1 million (2022: €225.5 million).

Thanks to improved profitability and despite higher investments and the financial burden from the contract manufacturing business with Continental, free cash flow amounted to €84.9 million in fiscal year 2023 (2022: €123.2 million). This was higher than Vitesco Technologies’ own forecast of approximately €50 million and the market consensus of €71 million.

Capital expenditures1 on property, plant, and equipment and software amounted to €499.8 million (2022: €446.6 million). The ratio of capital expenditures to sales was therefore 5.4 percent (2022: 4.9 percent).

As of December 31, 2023, Vitesco Technologies’ equity ratio stood at 37.6 percent (December 31, 2022: 40.3 percent). The company reported net liquidity of €337.0 million as of December 31, 2023 (December 31, 2022: €333.4 million).

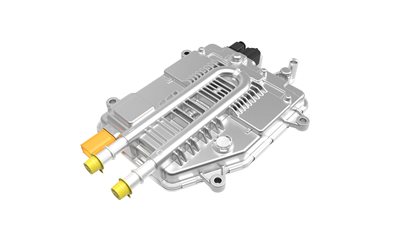

Vitesco Technologies generated sales of around €1.3 billion from electrification components in 2023 (2022: €1.1 billion). The reason for the less significant increase in sales was the softening of demand for electrification components in the market in the fourth quarter of 2023. The numerous project ramp-ups could not compensate for this effect.

In fiscal year 2023, total order intake came to more than €12 billion (2022: €14 billion). Roughly €8.3 billion of that amount was attributable to electrification components (2022: €10.4 billion).

As of December 31, 2023, Vitesco Technologies had a total order backlog of around €58 billion, of which more than half was related to electrification for the first time.

“The large number of product launches in 2023 and this year confirm our attractive electrification portfolio. With our strong partnerships, for example in form of long-term supply contracts for silicon carbide, we consider ourselves well prepared in this regard,“ says Wolf.

Consolidated net income came to -€96.4 million in 2023 (2022: €23.6 million). Despite the improvement in earnings at operating level, earnings per share decreased to ‑€2.41 (2022: €0.59). This was mainly due to a high tax burden as a result of write-downs on loss carryforwards at the German subsidiaries in connection with Schaeffler AG’s tender offer.

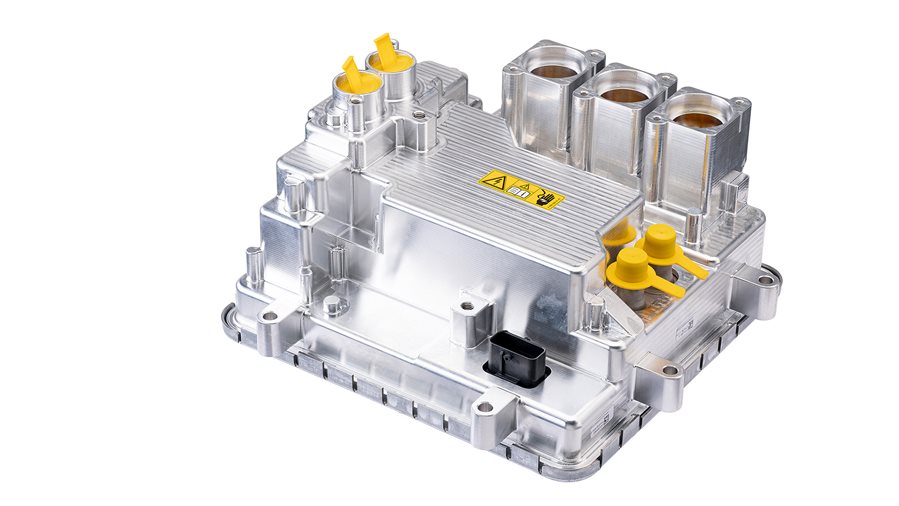

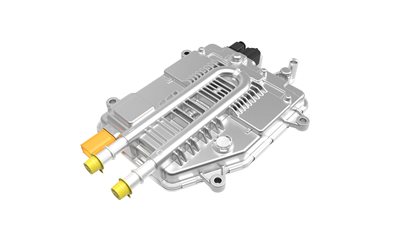

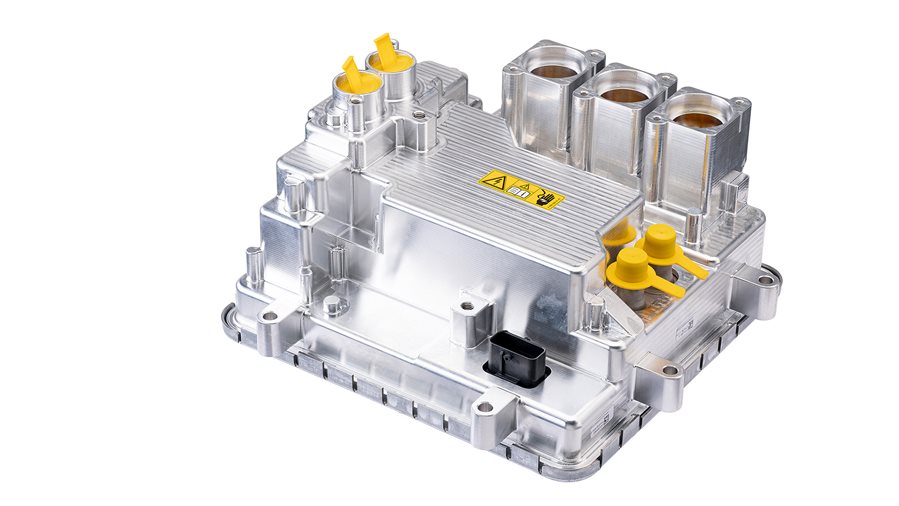

© Vitesco Technologies GmbH (exclusive rights)

At the Annual General Meeting on April 24, 2024, the Executive Board and Supervisory Board will propose a dividend distribution of €0.25 per share.

By concentrating on two divisions instead of four since the start of 2023, the company is sharpening its strategic focus on electrification of the drive system in order to operate more effectively, efficiently, and flexibly in the market for sustainable drive technologies.

Sales generated by the Powertrain Solutions division decreased to €6.12 billion in 2023 (2022: €6.37 billion). Adjusted for changes in the scope of consolidation and exchange-rate effects, the decrease amounted to 1.4 percent. The decline in sales was chiefly attributable to the planned reduction in contract manufacturing for Continental and the disposal of business units.

Adjusted EBIT of the Powertrain Solutions division improved year on year and was up by €119.3 million or 34.5 percent to €464.6 million in fiscal year 2023 (2022: €345.3 million). This equates to 7.6 percent of adjusted sales (2022: 5.5 percent). The positive operating activities – especially in the division’s core business – are the reason for this development.

In fiscal year 2023, sales in the Electrification Solutions division climbed by 14.3 percent to €3.16 billion (2022: €2.77 billion), driven by the strong performance in China and Europe.

Adjusted EBIT of the Electrification Solutions division declined year on year and was down by €5.0 million or 5.4 percent to -€98.1 million in fiscal year 2023 (2022: -€93.1 million). This equates to -3.1 percent of adjusted sales (2022: -3.4 percent). The increase in ramp-up costs for new projects was a key factor here.

“We are confident that we will reach the break-even point in the electrification business in 2024. That is an ambitious goal, but achievable,” said Nitzsche.

In view of the challenging market environment and the planned significant decline in contract manufacturing activities with Continental, Vitesco Technologies is forecasting sales of between €8.3 billion and €8.8 billion. Due to the increase in profitability that is anticipated in the electrification business, the company expects to generate an adjusted EBIT margin of between 4.5 percent and 5.0 percent. The company is also forecasting a negative free cash flow of around €350 million in 2024, owing mainly to negative effects from reduced contract manufacturing activities and the repayment of start-up financing to Continental.

Due to the high number of product launches this year, especially in the second half of 2024, we expect our investment ratio2 to be around 7 percent of sales for the year as a whole - with a full focus on investments in electrification.

The Annual General Meeting will take place on April 24, 2024.

1, 2 Excluding right-of-use assets under IFRS 16